Energy Tax Credit 2025 Income Limits. Estimated tax credits to be allocated in 2025. The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2025 to 2032.

Federal Solar Tax Credits for Businesses Department of Energy, $21,500,000 in 2025 lihtcs for the 2025 9% round. Department of treasury and internal revenue service (irs) jan.

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs & Stratton Energy Solutions, $21,500,000 in 2025 lihtcs for the 2025 9% round. 1, 2025, eligible consumers will have the option to transfer the value of the tax credit to dealers that meet.

Solar Tax Credit What You Need To Know NRG Clean Power, In addition, there are annual limits of $600 for credits with respect to qualified energy. Households with income at or above.

Federal Solar Tax Credits for Businesses Department of Energy, However, the eligibility rules for previous years are similar to the rules for the 2025 oeptc. There are currently available tax credits for many types of energy efficient home equipment and products.

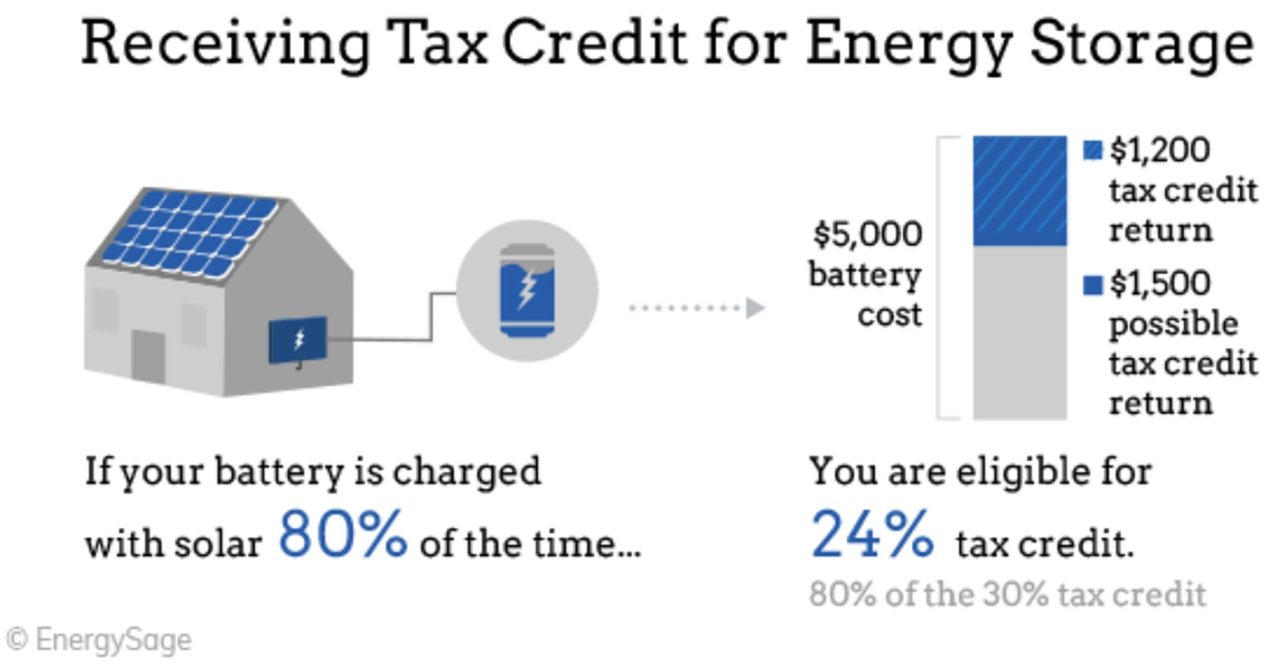

Residential Energy Tax Credits FF(10.14.2019) Tax Policy Center, 30% tax credit up to $150 per year; Energy efficient home improvement credit;

Unpacking the new solar energy tax credit BDO, In addition, there are annual limits of $600 for credits with respect to qualified energy. 18 announced that more than 1,000 projects are registered through the irs.

New Residential Energy Tax Credit Estimates Eye On Housing, The ultimate federal solar energy tax credit guide For buyers to be eligible to claim or transfer a credit starting january 1, 2025, the dealer they purchase their vehicle from must first register with energy credits.

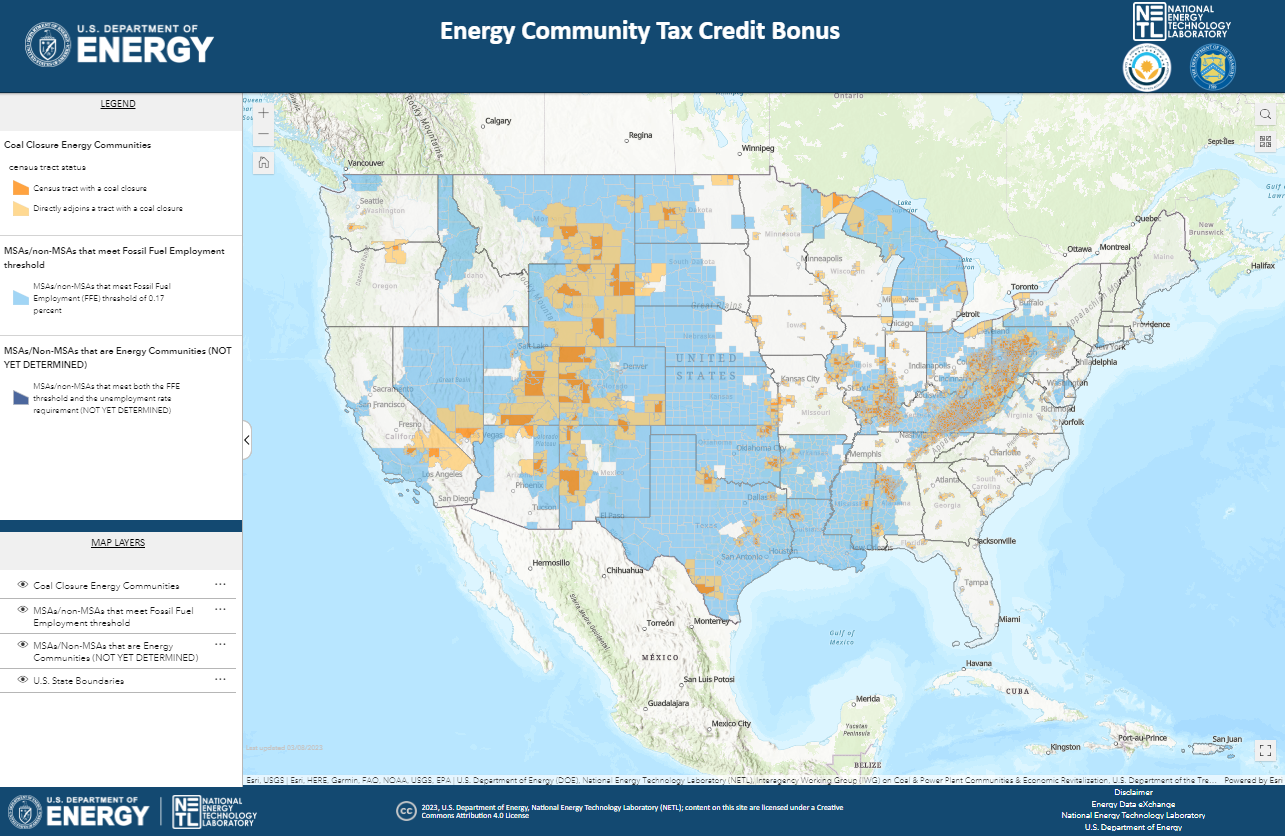

Energy Community Tax Credit Bonus Energy Communities, Home energy efficiency tax credits. Households with income less than 80% of ami:

Residential Energy Tax Credits Overview and Analysis UNT Digital Library, Before 2025, buildings qualifying for the 45l tax credit needed to consume at least 50% less heating and cooling energy than those compliant with the 2006. From solar panels to evs and insulation, there's a lot of money on the table this tax season.

Residential Energy Tax Credit Use Eye On Housing, Solar tax credit by state in 2025: However, the eligibility rules for previous years are similar to the rules for the 2025 oeptc.

Before 2025, buildings qualifying for the 45l tax credit needed to consume at least 50% less heating and cooling energy than those compliant with the 2006.